How to Dollar Cost Averaging in Crypto?

Dollar Cost Averaging is an increasingly popular way to invest in cryptocurrencies on a regular basis. In this article, we'll show you how to get started with dollar cost averaging in crypto in four easy steps.

What is dollar cost averaging (DCA)?

Dollar Cost Averaging is an investment strategy to invest in a financial asset at equal intervals with equal amounts. You invest in fixed time intervals with always the same amounts in an asset.

If the price of the asset is high, then you get less per purchase. If the price is low, you will receive more of the asset. With this strategy, your goal is to track the price movement of the asset over a longer period of time.

Example Dollar Cost Averaging Bitcoin

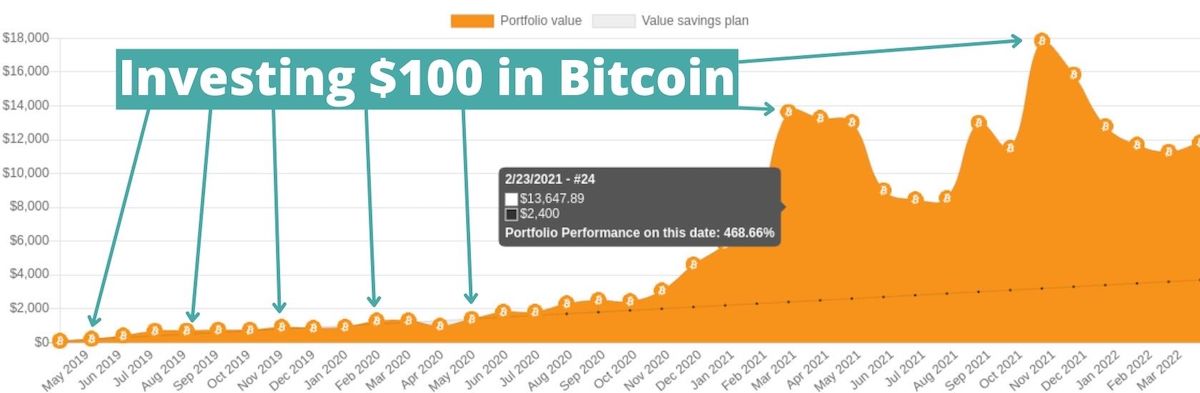

Let's say you decide to invest $100 every month in Bitcoin. How has this performed over the last three years?

Check out our Crypto DCA calculator.

Step 1: Choose a high-quality crypto asset

Dollar Cost Averaging is a long-term strategy for investing in cryptocurrencies. Therefore, it is very important to choose a cryptoasset that you believe in for the long term and that can survive in the market for the long term. Speculation and trading is out of place here.

Bitcoin is often used as an example, as Bitcoin was the first cryptocurrency to successfully exist on the market for over a decade in 2009. Think and decide wisely in which asset you want to invest for the long term. This first step is the most important step.

Step 2: Choose an investing interval

Consider the time intervals at which you want to invest in the cryptoasset. Common intervals are weekly, bi-weekly or monthly. There are also options to invest daily or quarterly.

Step 3: Choose an investing amount

The smaller the time intervals are, the smaller the invested amount should be. Think about the amount you are willing to invest in a cryptoasset over a longer period of time (e.g. 1 year).

Step 4: Choose a cryptocurrency broker

In order to be able to invest in the selected cryptoasset as automatically as possible, you should choose a reputable crypto exchange. First and foremost, you should check whether the broker also offers savings plans on cryptocurrencies for the selected coin. Secondly, it is important to check whether the broker also offers the service in your country of origin.

Now you should have a number of stock exchanges to choose from. You can select the exchange according to these (further) criteria:

- Coin availability

- Country of origin availability

- Trading fees

- Deposit options (e.g. bank transfer)

In our overview you will find many different crypto exchanges, sorted by your criteria.

Step 5: Setup up the Crypto Savings Plan

To set up the crypto savings plan, most exchanges require you to set up a standing order to the crypto exchange. Make sure that the money reaches the crypto exchange in time. In case of a bank transfer, you should transfer the amount a few days before.

Next, you can set up the savings plan on your crypto exchange.

Now you can watch your cryptoasset grow little by little. :)