DCA OUT Strategies for Bitcoin and Cryptocurrencies

The term Dollar Cost Averaging, or DCA for short, is used in the crypto sector to describe various strategies for using the dollar average cost effect when buying Bitcoin and other cryptocurrencies.

The crypto savings plan method offers advantages over buying ‘on instinct’. This means that the savings plan buys cryptocurrencies emotionlessly, regularly and automatically according to a clearly defined strategy. This method has been extremely successful, especially during accumulation phases in crypto bear markets, as CryptoDCA's historical crypto savings plan calculator shows.

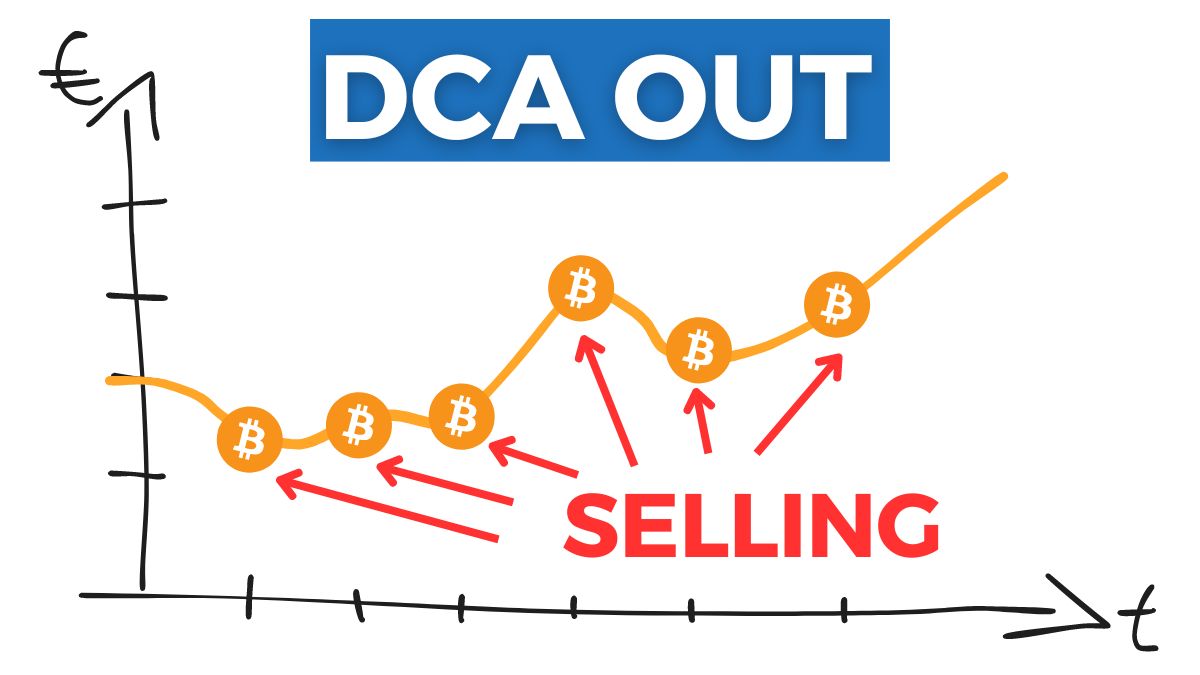

But what happens if the crypto bull market kicks in and you want to sell? Can you apply the crypto savings plan in reverse? In this article, wse take a look at the DCA OUT strategy.

What is DCA OUT?

DCA OUT describes the selling of cryptocurrencies according to the DCA strategy. While the classic DCA strategy aims to buy Bitcoin or other cryptocurrencies, DCA OUT attempts to achieve the exact opposite.

The problem: High crypto asset share in bull markets

Many crypto investors quickly achieve their monetary goals in a crypto bull market. Altcoins in particular can rise explosively and subsequently make up a large proportion of an investor's total assets. In order to minimise the cluster risk, clever crypto investors reduce their holdings in cryptocurrencies in this market environment and switch to other assets or monetary values.

But when exactly do you sell? By selling prematurely, aren't you missing out on further large and quick gains that were not uncommon in the last bull markets?

These are important questions, but probably nobody has an answer to them, even though many market gurus repeatedly predict (in vain) when the peak of a bull market will be reached.

So either sell too early and miss out on (potential) profits or sell too late and end up empty-handed? Are there only these two options?

No, because the DCA OUT strategy tries to find a compromise here by selling cryptocurrencies automatically, regularly and emotionlessly on the way to the peak.

DCA OUT methods

What are the different ways to use a DCA OUT strategy? If you follow the numerous posts on Reddit, you will realise that there are two broad tendencies. Static and dynamic. Both methods have a number of starting metrics that should be defined in advance.

- Starting point for sale. Date or market value of the cryptocurrency

- Total sales amount or whether an amount of the cryptocurrency should never be sold

- Currency to be accumulated. Example: US Dollar, Euro, USDT, Bitcoin

- Place of sale. Crypto exchange, broker or decentralized exchange

DCA OUT Static

The static DCA OUT strategy is a method in which the sales amount per sale is not changed. The strategy therefore does not adapt and ‘rigidly’ sells the same amount per sales period. This method is similar to the normal ‘crypto savings plan’ offered by many providers.

Example 1

Sell the equivalent of €100 worth of Bitcoin in euros every week until 0.1 BTC has been sold. Start as soon as Bitcoin is over 60000€.

| Period | BTC price | Sales value in BTC | Sales value in € | Remaining quantity BTC |

|---|---|---|---|---|

| 1 | 60000€ | 0,0016 | 100€ | 0,0984 |

| 2 | 70000€ | 0,00143 | 100€ | 0,09697 |

| 3 | 65000€ | 0,00154 | 100€ | 0,09543 |

| 4 | 60000€ | 0,0016 | 100€ | 0,09383 |

| 5 | .. | .. | .. | .. |

DCA OUT Dynamic

With the dynamic DCA OUT strategy, the selling amount is adjusted dynamically. An attempt is made to sell more or less depending on the market situation. However, the strategy cannot be changed subsequently.

Example 1

Sell 10% of your Ethereum holdings (2 ETH) for every 10% price increase in euros. Start as soon as ETH is above 3000€. Do not sell if ETH is below the last executed sell phase.

| Period | ETH price | Sales value in ETH | Sales value in € | Remaining quantity ETH |

|---|---|---|---|---|

| 1 | 2800€ | 2 | ||

| 2 | 3100€ | 0,2 | 620€ | 1,8 |

| 3 | 3300€ | 0,18 | 660€ | 1,62 |

| 4 | 2900€ | 1,62 | ||

| 5 | .. | .. | .. | .. |

| 6 | 3500€ | 0,162 | 700€ | 1,458 |